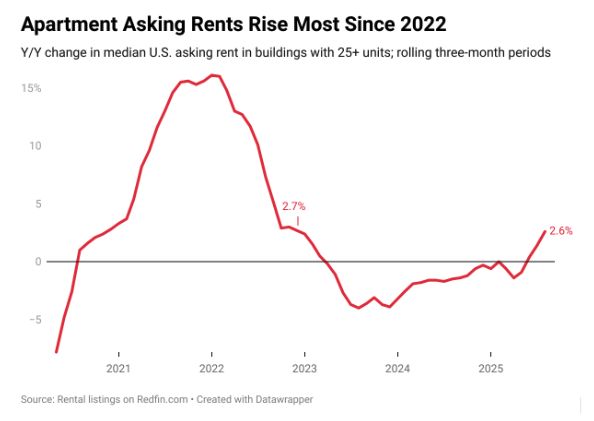

For the first time in more than two years, the U.S. rental market is tilting in favor of landlords. In August, the median asking rent climbed 2.6% year over year to $1,790 – the sharpest increase since December 2022.

While still $70 below the summer 2022 record high, this shift signals important opportunities for real estate investors focused on cash flow and long-term appreciation.

Why Rents Are Rising Again

After a period of flat or declining rents, August marked the third consecutive annual increase. The underlying driver, supply – or rather, the lack of it.

Multifamily construction permits have dropped 23.1% since the pandemic boom. With fewer apartments coming online, landlords are regaining leverage just as demand strengthens, fueled by high homeownership costs that keep many renters in the market.

Where the Growth Is Happening

Not all markets are moving in the same direction. Tech-driven hubs like San Jose (+8.8% increase in YoY asking rent), Chicago (+8.6%), and Washington, D.C. (+8.5%) are leading the surge, reflecting both shrinking supply and strong demand. Meanwhile, metro areas with more aggressive permitting, such as Jacksonville (-3.5%) and Austin (-2.6%), are seeing rents soften, according to Redfin.

The takeaway for investors: market fundamentals matter. Regions with tighter supply pipelines are positioned to deliver the strongest rent-driven returns in the near term.

Apartment Sizes Tell a Story Too

Smaller units are leading the recovery. Studio and one-bedroom rents rose 4.4% year over year to $1,650, the fastest growth since late 2022. Two-bedroom units rose 3.6%, while larger three-bedroom units stayed flat, according to Newsweek. For investors, this suggests growing demand for affordable entry-level rentals, a segment that often provides steady occupancy and reliable income.

Why This Benefits Real Estate Investors

For landlords and rental real estate investors, the rise in apartment rents creates an opportunity:

- Improved cash flow: Rising rents strengthen monthly margins.

- Better loan metrics: Higher net income enhances DSCR ratios.

- Upside potential: Limited supply today sets the stage for continued rent growth tomorrow.

How This Ties into DSCR Loans

Rising rents directly support stronger Debt Service Coverage Ratios (DSCR), the cornerstone metric for rental property financing. Higher income against steady expenses improves both loan eligibility and long-term performance. In short, the current rent environment gives investors more breathing room to leverage financing confidently while scaling their portfolios.

Partnering With Dominion Financial

At Dominion Financial, we specialize in helping investors act on these market shifts. Our DSCR rental loans come with a price-beat guarantee, fast closings, and qualification based on property cash flow, not personal income, making it easier for you to capture opportunities while the market is moving in your favor.

Whether you’re growing your holdings in a rent-growth metro or diversifying into steady-performing markets, Dominion Financial has your back.

INVESTOR TAKEAWAYS

After two years of stagnation, limited new supply is driving rents higher. Multifamily construction permits have dropped over 23% since the pandemic boom, giving landlords renewed pricing power.

Tech and business hubs like San Jose (+8.8%), Chicago (+8.6%), and Washington, D.C. (+8.5%) are leading the rebound thanks to shrinking inventory and resilient demand.

Higher rents translate into stronger cash flow, better Debt Service Coverage Ratios (DSCRs), and improved property valuations — all key metrics for scaling an investment portfolio.

Smaller units—studios and one-bedrooms—are seeing the fastest rent growth. These units cater to renters priced out of homeownership and often provide consistent occupancy.

DSCR loans base qualification on property income, not personal income, making it easier for investors to expand portfolios as rents rise. Dominion Financial’s price-beat guarantee and fast closings help investors move quickly while market conditions are favorable.