Two years ago, Dominion Financial spotlighted Our House Your Home LLC and their ambitious build-to-rent strategy. At that time, founders Jeffrey and Becky Maynard set out with a goal to deliver 50 high-quality, affordable homes for underserved tenants in Wilmington, North Carolina.

By mid-2024, however, the supply of vacant infill lots that had fueled their early growth had slowed dramatically. “We hit a point where the lots that met our economic criteria were rarely coming for sale anymore,” Jeffrey explained. “But even during tougher times, opportunities still exist for teams that are driven and creative.”

Rather than pulling back, the Maynards leaned on their creativity and their partnership with Dominion Financial to keep their affordable housing mission alive. By embracing zoning changes, experimenting with innovative design, and reimagining how to configure homes on challenging lots, they continued moving forward. In doing so, they surpassed their 50-home milestone. They also proved that resilience and adaptability can turn market obstacles into new opportunities.

Breaking New Ground with ADUs

One of Our House Your Home’s most exciting recent projects takes advantage of a local zoning ordinance change that opened the door to accessory dwelling units (ADUs).

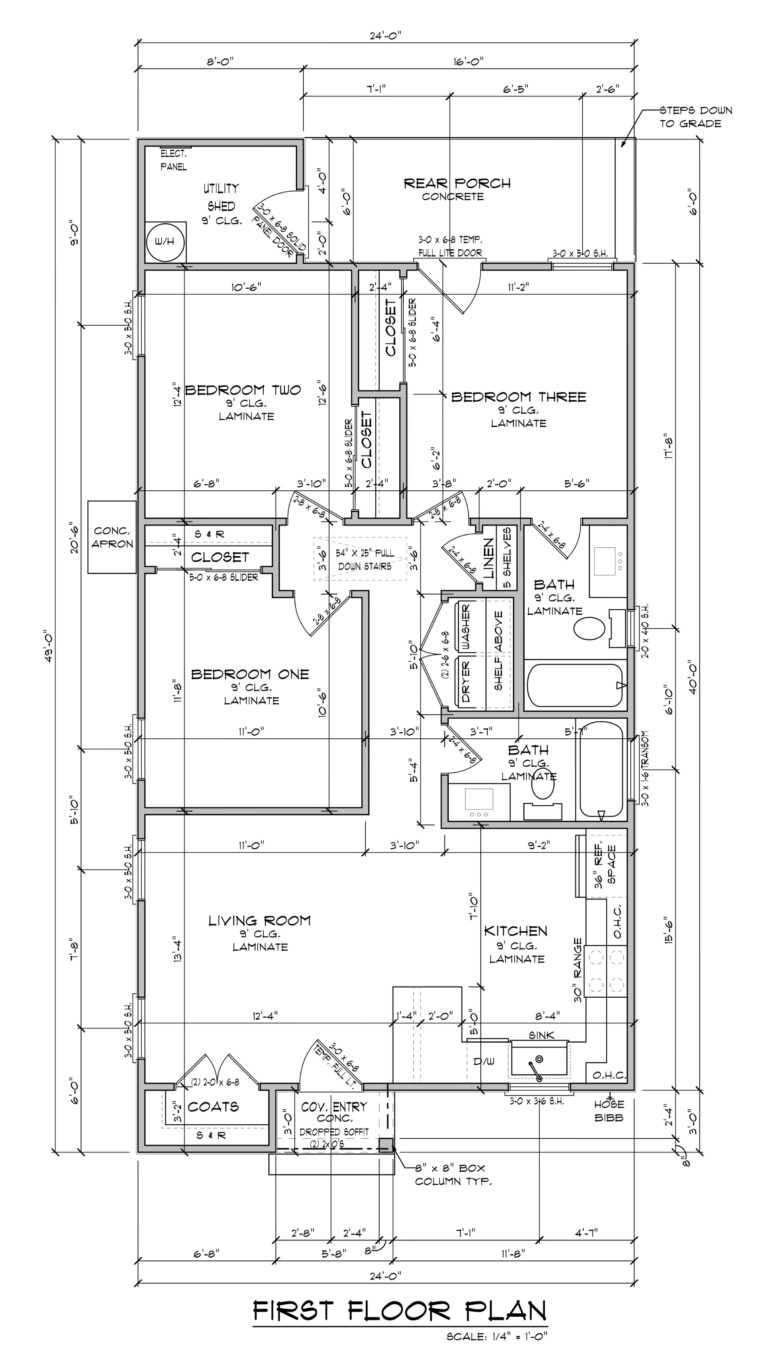

With financing from Dominion Financial, the Maynards and their build partner Herrington Classic Homes have already built nearly 20 homes using their 1,944 sq. ft., 5BR/3BA “Pelican” plan (see image). This design has quickly become a favorite among large families in the Wilmington area. Local zoning code limits ADU square footage to no more than 50% of the principal dwelling’s living area. To meet that requirement, the Maynards designed a fully detached 972 sq. ft. 3BR/2BA ADU cottage (see image).

Despite the smaller footprint, the ADU incorporates all their housing program’s signature features, such as: high ceilings, a bedroom with a private bath, full-size kitchen appliances, dedicated coat and shoe storage for kids, a full laundry room, and off-street parking. Smart design ensured the house and ADU made the most of the lot, with alley access behind the main house for the ADU.

“This is a great project and the first like it here,” said Jeffrey. “The zoning ordinance changes for ADUs gave us the chance to design something entirely new, and we’re proud that even within the size limitations, we designed a three-bedroom, two-bath home with all the features families hope for.”

Reinventing the Duplex

On a nearby lot on the same street, Our House Your Home developed another first for their program: a “back-to-front” duplex design (see image). Both units use their proven 18-foot-wide “Seagull” plan (4BR/2BA), a layout they have built more than 20 times with Dominion Financial financing. By placing one unit behind the other and shifting it six feet to the left, the team fit two townhomes within the narrow 33-foot city lot. They still met setback requirements and maintained livability.

“This design lets us maximize the value of tight urban lots without compromising on what families need,” explained Jeffrey. “It’s the same Seagull plan that has worked so well for us and for dozens of families, just adapted in a way that makes the land work harder.”

Rather than being constrained by the narrow footprint, the Maynards designed each unit to maximize privacy, comfort, and the amenities renters value most, such as private parking and outdoor space. This configuration, combined with the new ADU rules, opens up new possibilities in areas where buildable land is scarce or oddly shaped.

By reimagining how their tried-and-true floor plans could be placed, the Maynards have shown that innovation doesn’t always mean creating something entirely new. You can also reshape what already works to unlock opportunities that others might overlook.

Reaching 50+ Homes and Changing Hundreds of Lives

With their most recent closings, Our House Your Home has now completed 51 rental homes, all financed by Dominion Financial. This milestone represents more than just numbers on a balance sheet. Over the years, the Maynards have provided stable, affordable housing to dozens of families. That effort has given more than 150 children a secure home, protecting them from the threat of housing insecurity.

One tenant’s story illustrates that impact. Three years ago, a single mother facing eviction from a mold-infested public housing project moved into an Our House Your Home rental. At the time, her daughters were just 15 and 16. Today, they are thriving young women, high school and community college graduates, and one works full-time at the local hospital. “They hugged and thanked me, and their mother told me we had changed their life,” Jeffrey recalled.

Stories like this, repeated across Wilmington, reveal the true outcome of Dominion Financial’s partnership with Our House Your Home. Every loan creates not just houses, but homes that transform lives.

A Shared Mission and a Bright Future

“We understand the challenges you face in your offices. Rates are always changing., Note buyers and insurance companies can be demanding, sometimes moving the goalposts or changing conditions and requirements,” the Maynards wrote to the Dominion Financial team. “But trust us when we say that Dominion and their staff are changing lives. Homes are the result of all that paper pushing and tedious work!”

For Dominion Financial, that partnership is just as meaningful. “We’ve been proud to support the Maynards from their first new construction home through and beyond their 50th,” said Jack BeVier, Partner, Dominion Financial. “They’ve proven that small developers with vision, persistence, and creativity can have an outsized impact on their communities.”

Despite fewer vacant lots being available, Jeffrey and Becky remain optimistic. With innovative site plans, new zoning opportunities, and Dominion Financial’s continued partnership, they plan to keep building homes and changing lives. “People need us,” Jeffrey said. “And we WILL find more great building opportunities.”